Voltaire, formerly known as KnowRisk.ai, is an AI-powered platform revolutionizing the insurance claims process by automating claims correspondence and significantly reducing operational costs and response times.

This rebrand highlights a broader ecosystem of “KnowRisk” initiatives, including KnowRisk®—an enterprise-wide risk management software integrating compliance, audit, and financial risk tools; the Knowrisk app for epilepsy management, offering AI-driven event forecasting and health tracking; and the knowRISK project focused on enhancing supply chain resilience through AI, geospatial intelligence, and federated learning. Together, these platforms reflect a growing trend of leveraging artificial intelligence to deliver smarter, faster, and more resilient risk management solutions across diverse sectors.

Voltaire (formerly KnowRisk.ai): Revolutionizing Risk Management with AI

Voltaire, formerly known as KnowRisk.ai in the insurance sector, represents a significant leap forward in the realm of risk management. Leveraging artificial intelligence (AI) and advanced data analytics, Voltaire (and other “KnowRisk” entities) provides comprehensive and proactive solutions across various sectors. While the name “KnowRisk.ai” might have referred to multiple distinct entities or initiatives focused on AI-driven risk solutions, it is now clearly established that the AI-powered platform for the insurance industry, particularly in claims processing, operates under the brand Voltaire.

There are also other distinct entities that continue to use the “KnowRisk” name: enterprise-wide risk management software (often branded as KnowRisk®), a “KnowRisk” app for epilepsy management, and a “knowRISK project” focused on supply chain resilience. This article will synthesize information about these diverse applications, highlighting their features, use cases, benefits, and market positioning, with a particular focus on the transition of KnowRisk.ai to Voltaire.

1. Voltaire (formerly KnowRisk.ai) – AI for Insurance Claims

What it is: Voltaire (formerly KnowRisk.ai) is an innovative AI-powered platform designed to revolutionize the insurance claims process. It aims to transform how insurance carriers handle claims correspondence and overall business operations. Voltaire is the operating brand of KnowRisk, Inc., a Nevada company.

Key Features:

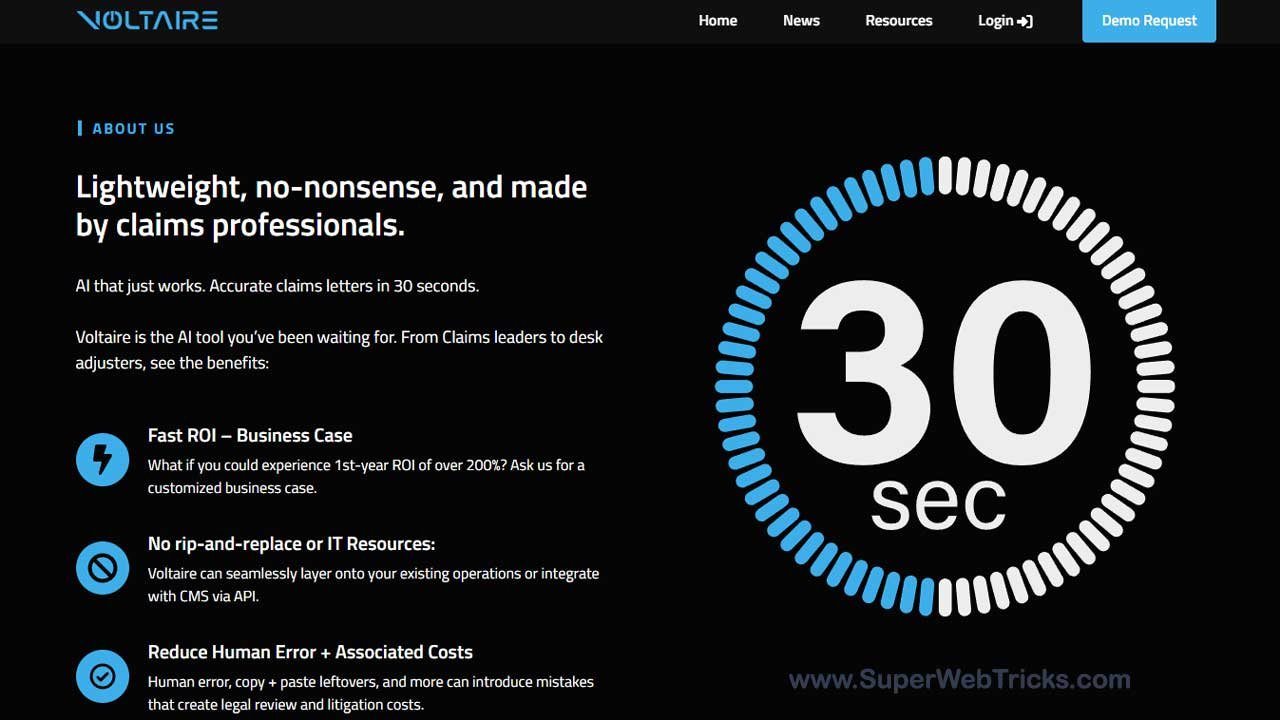

- AI-Powered Claims Letter Generation: Significantly reduces the time to generate a claims letter from approximately 30 minutes to a remarkable 30 seconds. This dramatically enhances productivity while reducing human error and associated costs.

- Automated Correspondence: Simplifies responses during catastrophic events and streamlines the claims creation process, minimizing manual errors and ensuring timely responses during crises.

- Regulatory Alignment: Ensures generated correspondence is accurate and aligns rigorously with regulatory requirements, reducing compliance risk.

- Data Integration: Utilizes policies, estimates, and other relevant data to generate accurate first draft claim letters for desk adjusters.

- Seamless Integration: Designed to layer on top of or integrate into existing claims management systems (CMS) with minimal-to-no IT resources or disruption of current workflows.

Use Cases:

- Automating Claims Operations: Transforms the efficiency and accuracy of claims processing for Property & Casualty (P&C) insurers.

- Reducing Operational Expenses (LAE): Lowers costs associated with manual claims correspondence, with initial use-case analyses showing Loss Adjustment Expenses (LAE) decreases of 20-25%.

- Mitigating Claims Leakage: Reduces instances of mistaken payouts or overpaying, with potential claims leakage reductions of up to 50%.

- Improving Response Times & Compliance: Enables timely and accurate, compliant responses during crises and high-volume periods, such as storm seasons, where adjuster efficiency is critical to meeting regulatory requirements and customer expectations.

- Enhancing Adjuster Productivity: Allows experienced and novice claims adjusters alike to complete at least one more claim letter per day, leading to manual labor savings equivalent to two hours per adjuster daily.

Leadership & Funding:

- CEO: Yo Sub Kwon, a co-founder of Coinsetter (acquired by Kraken) and LaunchKey (acquired by TransUnion). He was also CEO of Hosho Group, a security analysis firm. Bryan Layne is also a co-founder and longtime claims expert.

- Funding: Voltaire (KnowRisk, Inc.) announced the successful close of a $4.2 million seed funding round on May 20, 2025. This round was led by FundNV, with participation from the 1864 Fund and its syndicate, alongside a matching investment from the Nevada Battle Born Growth Escalator Inc. (NBBGEI). Prior filings with the U.S. Securities and Exchange Commission in February 2025 indicated KnowRisk was raising up to $6.41 million in new equity investment, suggesting the seed round contributed significantly to this target.

2. KnowRisk® – The Enterprise Risk Management Software

What it is: KnowRisk® is a sophisticated, dedicated risk management software designed for professionals, uniquely integrating risk, compliance, and internal audit programs. It provides a comprehensive framework for businesses to identify, evaluate, and mitigate potential risks across the enterprise.

Key Features:

- Integrated Platform: Unifies risk, compliance, and internal audit functions, offering a holistic view of an organization’s risk landscape.

- Learning Database: Gathers insights from past experiences, allowing the system to continuously improve its risk identification and assessment capabilities.

- Simplified Navigation: Provides intuitive methods and steps for users to navigate the software.

- Customizable Report Writer: Enables the generation of tailored reports and dashboards for real-time, interactive reporting.

- Enterprise-Wide Application: Designed for use across an entire organization, ensuring consistent risk management practices.

- Database Replication and Synchronization: Allows for the replication and synchronization of selected information across multiple databases.

- Inherent Methodologies: Comes pre-loaded with established methodologies to jumpstart risk and compliance strategies, with contributions from leading industry experts.

- Deployment Options: Available as Web-Based, On-Premises, and mobile applications (iPhone, iPad, Android). Also compatible with Windows, Mac, Linux, and Chromebook.

- Customer Support: Offers business hours support, 24/7 live representatives, and online support.

- Training: Provides training documentation, webinars, live online training, and in-person sessions.

- Specific Modules/Capabilities:

- Financial Risk Management: Includes compliance management, credit risk management, liquidity analysis, loan portfolio management, market risk management, operational risk management, portfolio management, risk analytics benchmarks, stress tests, and Value at Risk (VaR) calculation.

- Compliance: Features archiving & retention, AI, audit management, compliance tracking, controls testing, incident management, risk management, and workflow/process automation.

- Fraud Detection: Utilizes AI for pattern recognition, flagging anomalies in transactions, and custom fraud parameters.

- Operational Risk Profiling: Helps in identifying and managing risks related to business operations.

- Project Management Risks: Assists in managing risks associated with projects.

Use Cases:

- Corporate Risk Management: Transforms corporate risk into opportunity by providing tools for comprehensive risk assessment and mitigation.

- Regulatory Compliance: Helps organizations adhere to new compliance measures mandated by regulators following financial disasters.

- Internal Audit: Streamlines internal audit processes by integrating them with risk and compliance programs.

- Operational Resilience: Enables businesses to evaluate areas of impact in advance, prepare for critical events, and mitigate operational disruptions.

- University Risk Management: Used by universities to manage risks, avoid duplication, customize forms, and generate reports.

Benefits:

- Enhanced Compliance: Ensures adherence to regulatory requirements and reduces the risk of non-compliance.

- Proactive Risk Mitigation: Identifies potential risks before they escalate into major issues, saving time and resources.

- Improved Decision-Making: Provides real-time insights and analytics for informed risk-related decisions.

- Increased Efficiency: Automates routine tasks, freeing up teams for more complex analysis and strategic planning.

- Enterprise-Wide Visibility: Offers a centralized view of all risks across the organization.

- Scalability: Available in Standard (for smaller groups/registers) and Professional (for larger teams/multiple registers) versions.

3. Knowrisk App (for Epilepsy Management)

What it is: The Knowrisk app is an innovative mobile application designed to assist individuals living with epilepsy and their caregivers in managing the condition.

Key Features:

- Event Forecasting: Utilizes AI to predict potential events, allowing users to prepare effectively.

- Trigger Identification: Helps users understand and track personal event triggers (e.g., sleep patterns, stress levels).

- Real-Time Alerts: Provides immediate notifications to the user and their caregivers.

- Comprehensive Tracking: Logs events, medications, and other health data for a holistic view.

- Community Support: Connects users with a supportive community.

- Expert Resources: Offers articles, tips, and personalized advice from medical professionals.

- Wearable Device Integration: Tracks health metrics like heart rate variability (HRV), physical activity, sleep quality, and more.

- Personalized Insights: Provides AI-driven analysis of real-life data to offer personalized tips and insights.

- Data Privacy: Emphasizes no data sharing with third parties without explicit consent.

Benefits:

- Reduced Uncertainty: Empowers individuals to regain control over epilepsy and live with fewer worries.

- Enhanced Quality of Life: By detecting subtle changes and triggers, it aims to reduce the frequency and severity of health events.

- Improved Patient-Provider Communication: Allows for data sharing with healthcare providers (with explicit consent) for more informed decisions.

4. knowRISK project (Supply Chain Resilience)

What it is: The knowRISK project is a consortium initiative utilizing AI, distributed ledger technologies (DLT), and geospatial intelligence (GEOINT) to collect, analyze, and verify risk insights, particularly for supply chain resilience. Digital Catapult is a key participant in this project.

Key Objectives:

- 360-Degree View of Risk: Aims to combine internal business data with accounting, insurance, legal (AIL) data, augmented by geospatial data, IoT data, and over 300 third-party data sources.

- Addressing Supply Chain Disruption: Developed to understand and mitigate risks to supply chains, particularly in the food and drink industry.

- Ethical AI Development: Focuses on applying AI ethics tools to ensure responsible data usage and address ethical concerns related to data privacy, transparency, and impact on SMEs.

- Federated Learning: Explores federated learning as a service (FLaaS) to address challenges in training machine learning models on distributed confidential data.

Market Position and Competition

The various “KnowRisk” and “Voltaire” entities operate in distinct but sometimes overlapping markets:

AI for Insurance Claims (Voltaire): Voltaire operates in the rapidly growing InsurTech market. Its specific focus on automating claims correspondence positions it against other AI-driven solutions aiming to streamline insurance operations. The ability to reduce claims letter generation time from minutes to seconds, along with its proven ROI and seamless integration capabilities, are significant competitive advantages.

Enterprise Risk Management Software (KnowRisk®): KnowRisk® competes with established GRC (Governance, Risk, and Compliance) and ERM (Enterprise Risk Management) solutions. Competitors mentioned include Predict360, A1 Tracker, and Accountable. Its strength lies in its integrated approach to risk, compliance, and internal audit, and its comprehensive features for financial and operational risk across an organization.

Epilepsy Management App (Knowrisk app): The Knowrisk app operates in the digital health and wellness market, specifically for chronic disease management. Its competitors would include other seizure tracking and epilepsy management applications. Its AI-driven forecasting and personalized insights are key differentiators.

Supply Chain Risk (knowRISK project): This is a collaborative research and development initiative, rather than a direct commercial product in the same vein as the software. It aims to develop foundational technologies and best practices for supply chain resilience, potentially influencing future commercial offerings.

Conclusion

The evolution of “KnowRisk.ai” to “Voltaire” in the insurance sector, alongside the continued operations of other “KnowRisk” branded initiatives, underscores a significant trend: the increasing application of advanced technologies, particularly AI, to address complex risk management challenges.

From comprehensive enterprise-wide solutions to specialized applications in insurance and healthcare, these initiatives demonstrate the power of data-driven insights and automation in enhancing preparedness, efficiency, and resilience in an increasingly uncertain world. As AI capabilities continue to evolve, the impact of solutions like those offered by Voltaire and KnowRisk are likely to become even more pervasive and critical across industries.

FAQs about Voltaire

What is Voltaire and how is it related to KnowRisk.ai?

Voltaire is the new brand name for the AI-powered insurance claims platform previously known as KnowRisk.ai. It specializes in automating claims correspondence and enhancing adjuster productivity.

What industries does Voltaire serve?

Voltaire primarily serves the Property & Casualty (P&C) insurance industry, helping carriers streamline claims processes and reduce operational costs.

What are the main features of Voltaire?

Key features include AI-generated claims letters, automated correspondence, regulatory compliance alignment, seamless CMS integration, and data-driven claims insights.

How much time can Voltaire save during claims processing?

Voltaire can reduce claims letter generation from 30 minutes to 30 seconds, significantly improving adjuster efficiency.

What are the benefits of using Voltaire in insurance operations?

It reduces Loss Adjustment Expenses (LAE) by up to 25%, cuts claims leakage by up to 50%, boosts compliance, and enables adjusters to process at least one additional claim per day.

Who leads Voltaire?

Voltaire is led by CEO Yo Sub Kwon, a serial entrepreneur and co-founder of Coinsetter and LaunchKey, with deep experience in cybersecurity and blockchain.

Is Voltaire a separate company from KnowRisk®?

Yes, Voltaire (formerly KnowRisk.ai) focuses on insurance claims automation, whereas KnowRisk® is a standalone enterprise risk management software for broader risk and compliance functions.

What is KnowRisk® used for?

KnowRisk® is used for enterprise-wide risk, compliance, and internal audit management. It supports functions such as financial risk analysis, operational risk profiling, and fraud detection.

Who typically uses KnowRisk® software?

Corporations, universities, and institutions that need to manage enterprise risks, streamline internal audits, and ensure regulatory compliance use KnowRisk®.

What platforms is KnowRisk® compatible with?

KnowRisk® is available on web-based systems, on-premises installations, and mobile apps for iPhone, iPad, and Android. It supports Windows, Mac, Linux, and Chromebook devices.

What kind of training and support does KnowRisk® offer?

Users have access to live online training, webinars, documentation, and in-person sessions, along with 24/7 customer support options.

What is the Knowrisk App?

The Knowrisk App is a digital health tool designed to help people with epilepsy manage their condition using AI-driven forecasting and real-time monitoring.

What features does the Knowrisk App provide?

It offers seizure prediction, trigger identification, real-time alerts, integration with wearable devices, personalized insights, and access to expert resources.

Who can benefit from the Knowrisk App?

Individuals with epilepsy, caregivers, and healthcare professionals can all benefit from its event tracking and communication tools.

Does the Knowrisk App share user data?

No, the app emphasizes strict data privacy and does not share information with third parties without explicit user consent.

What is the knowRISK project?

The knowRISK project is an R&D initiative that uses AI, distributed ledger technology, and geospatial data to improve supply chain resilience, especially in food and beverage sectors.

What organizations are involved in the knowRISK project?

Digital Catapult and other partners form the consortium behind the knowRISK project, focusing on ethical AI development and federated learning models.

What are the goals of the knowRISK project?

Its goals include creating a 360-degree view of risk, integrating diverse data sources, and developing tools to mitigate supply chain disruptions.

Is the knowRISK project a commercial product?

No, it’s a research initiative, not a commercial software product. However, it may influence future risk management technologies.

How do these platforms differ from each other?

Voltaire focuses on insurance claims, KnowRisk® on enterprise risk management, the Knowrisk App on epilepsy care, and the knowRISK project on supply chain risk innovation.

What connects all the KnowRisk entities and Voltaire?

All share a common theme of using AI and data analytics to manage and mitigate risk in different domains—insurance, corporate governance, healthcare, and logistics.

Where can I learn more about Voltaire?

You can visit https://voltaire.claims for more information about the platform and its capabilities.

Leave a Reply

You must be logged in to post a comment.